Weekly Market Recap

In yet, another strong week the major indices are on their way to gain further as expected. This is seventh consecutive weekly gain except for one-week shake-out kind of pause since blow-off kind of rally started from the level of 9000 in NIFTY and 30000 in SENSEX.

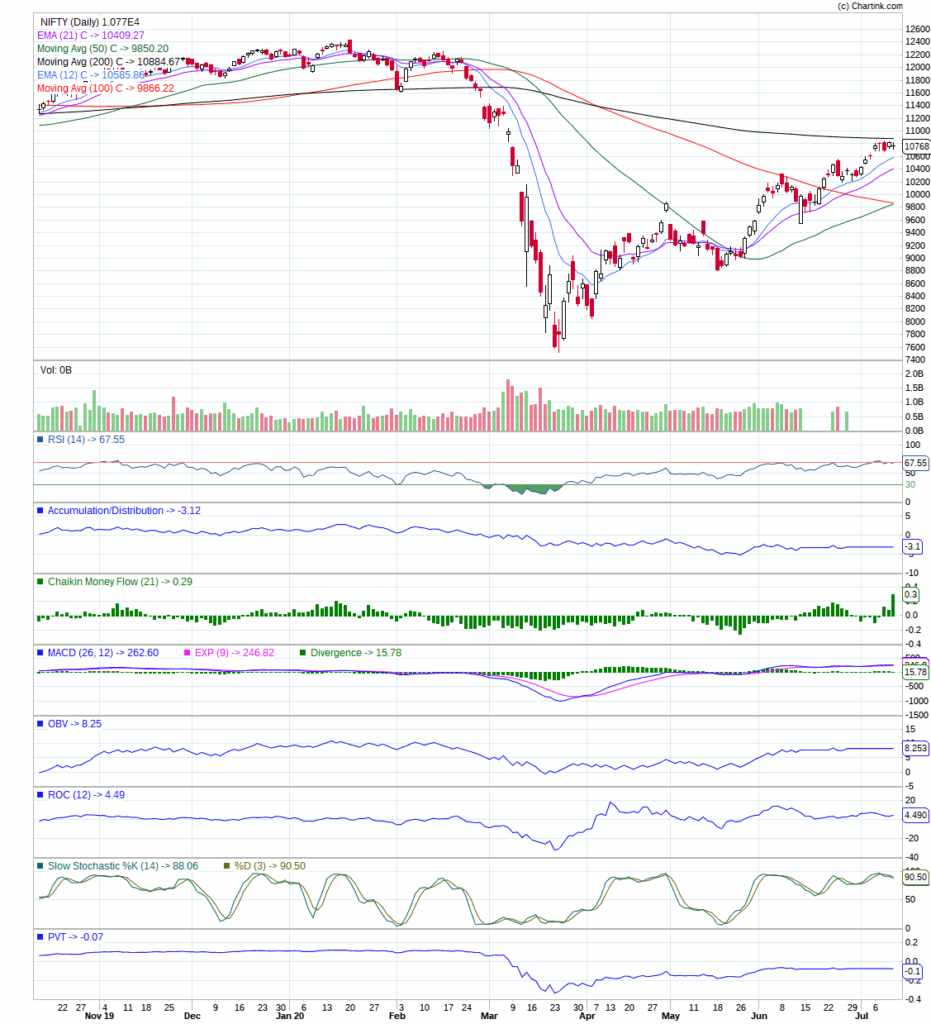

In the week gone by the benchmark SENSEX gained 572 points, or 1.59% to close at 36594, similarly, NIFTY surged 160 points, or 1.51% and settled at 10768. While BANKNIFTY slightly outperformed with a gain of 2.5%.

Current Outlook

In the present conditions, perhaps, we are witnessing the most incredible aspect of the market with the ever-changing landscape of investment and trading opportunities. I have been spending lot of time in analysing and observing the market and I found the rules are changing. The metrics have changed. The world has changed. The way of doing business has changed or changing. However, I still, would rely on my tried and tested investment and trading model that has never steer me wrong for a long-time. Though, sometimes it took longer than expected time to get the expected outcome, but it comes. Like, I had been maintaining my bearish stance on the market through out since mid-2019, but the fall came in March 2020. Nevertheless, it was unprecedented cascading fall that was enough to cause a ruckus and pandemonium not only in the market, but among investors too. As I always write, patience is the key for your success along with blend persistence with experiment.

Since past two weeks, based on given technical configuration I have been writing and expecting the market to move higher; especially the selected group of individual stocks as they are ostensibly well placed on the risk reward ratio and their action is overwhelmingly positive . However, the market breadth which was positive until past week has started to deteriorate again while indices continued to advance, ideally that is not a healthy configuration, but as I wrote above rules are changing as a result expensive stocks are becoming expensive and cheap stocks are getting cheaper. In the long run this is not sustainable, in fact is quite vulnerable to collapse as normal correction in heavy weight stocks evince deeper in index.

Technically, this week price action on NIFTY was almost contained, except for one day gap-up opening on Monday as shown in the chart below. That indicates loss of momentum, most importantly that containment of price is precisely at below 200 SMA (black line). It is indispensable for the NIFTY to cross and sustained above 200 SMA to resume its long-term up-trend. Hence, it is befitting to observe the price at crucial level before we anticipate anything as ambiguity is rising with greater degree that makes the outlook blurred.

Conclusion

The current state of the market is quite bewildering, however, provided the capriciousness condition of the market, focussing on individual stocks is worth-while. Remember, greed hasn’t yet taken over the fear completely, but warning sign has emerged, so we should be prepared with exist strategy if required, until then buying with stick stop on selected group of stocks is apposite.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Keep Analysing…!, Be a Savvy Investor..!!

Pankaj