Weekly Market Recap

In my last week message, I was cautioned and stated that NIFTY looked like to have formed a double-top formation which suggested at least some sort of pull back is coming, but it didn’t happen, in fact, market recouped last week loss in an effervescent manner and closed almost at the recent high.

Eventually, in the week gone by the benchmark SENSEX surged 557 points, or 1.47% and reached at 38434, similarly, NIFTY gained 193 points, or 1.73% to close at 11371. While BANKNIFTY did outperform with a gain of 2.86%.

Current Outlook

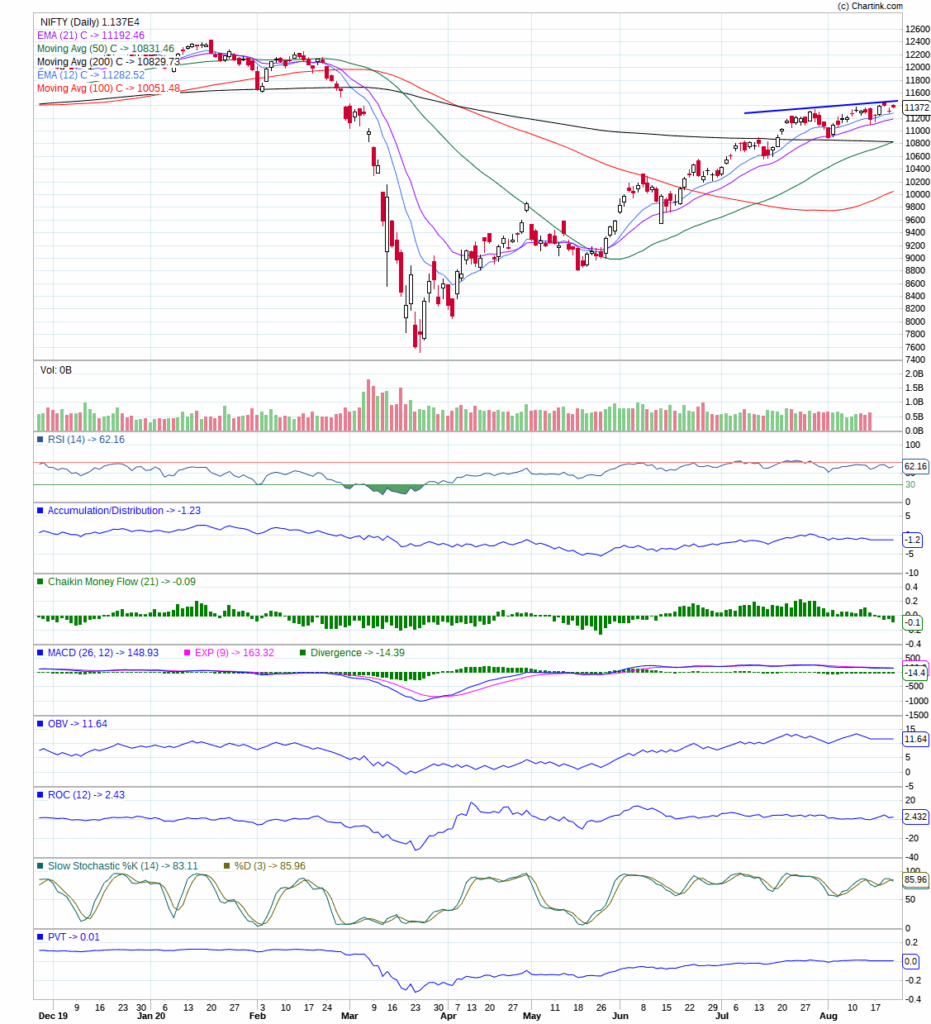

Although, NIFTY has posted a solid weekly gain and left an impression to gain further, however, the nuances of technical analysis says the double-top formation is still in play unless NIFTY closed above the blue line as drawn on the chart below, which is slightly titled upward. Especially, in last three days NIFTY has witnessed an agitated and turbulent move but the net result is almost flat that shows the tug-of-war between demand and supply at current level which needs to be monitored carefully. However, the good news is banking stocks this week appeared to be resilient and done relatively better in contrast to benchmark indices. If the same action from financials continued, then I think NIFTY shall rise to achieve its previous all-time high sooner than expected, but only, when if condition is fulfilled incessantly.

In addition, the market breadth this week was consistently strong except for one day, along with declining VIX that’s another strong sign. Technology and Metals continued to perform well, added strength to the market. Nevertheless, despite all these strong clues NIFTY is hovering in the last three-week range which has resulted in developing negative divergence among few important technical indicators that is only a cause of concern at this point in time rather than a major worry. In a strong up move, few days of consolidation in stock price normally resultant into divergence among technical indicator which is sometime platitude in nature while in others it’s a sign of reversal. Because divergence indicates diminishing momentum which is foremost thing before the price get reverse.

Hence, outlook appears to be positively biased on the back of support by financials, however, it may deteriorate suddenly if financials lost its resilience.

Conclusion

So far, the trend is up, though the market is remained in last three-week range but that doesn’t imply that the uptrend is over, but yes, it is in danger as long as market is resting on the mercy of financials. The likely double-top formation offers some perspective on the market in the short-term as I mentioned last week and show where potential support levels lie if a pull back were to occur. Nonetheless, I would suggest sticking to stock specific strategy, which is doing quite well, but be prepared to exit immediately if required.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Trade with discipline; Be a Savvy Investor…!

Pankaj