Weekly Market Recap

Since past three weeks, I have been talking about bearish engulfing candle formed on weekly chart and based on its credibility in past five years, I expected market to follow the same route that is pull back of some magnitude. I would say, what a precise prodigy it was, NIFTY posted a biggest weekly fall since March though NIFTY recovered more than 200 points on Friday, yet it’s a biggest weekly fall in six months.

In the week gone by the benchmark SENSEX plunged 1457 points, or 3.75% to close at 37288, similarly, NIFTY lost 454 points, or 3.95% to settle at 11050. While BANKNIFTY maintained its underperformance with an extra 1% loss of 4.76%.

Current Outlook

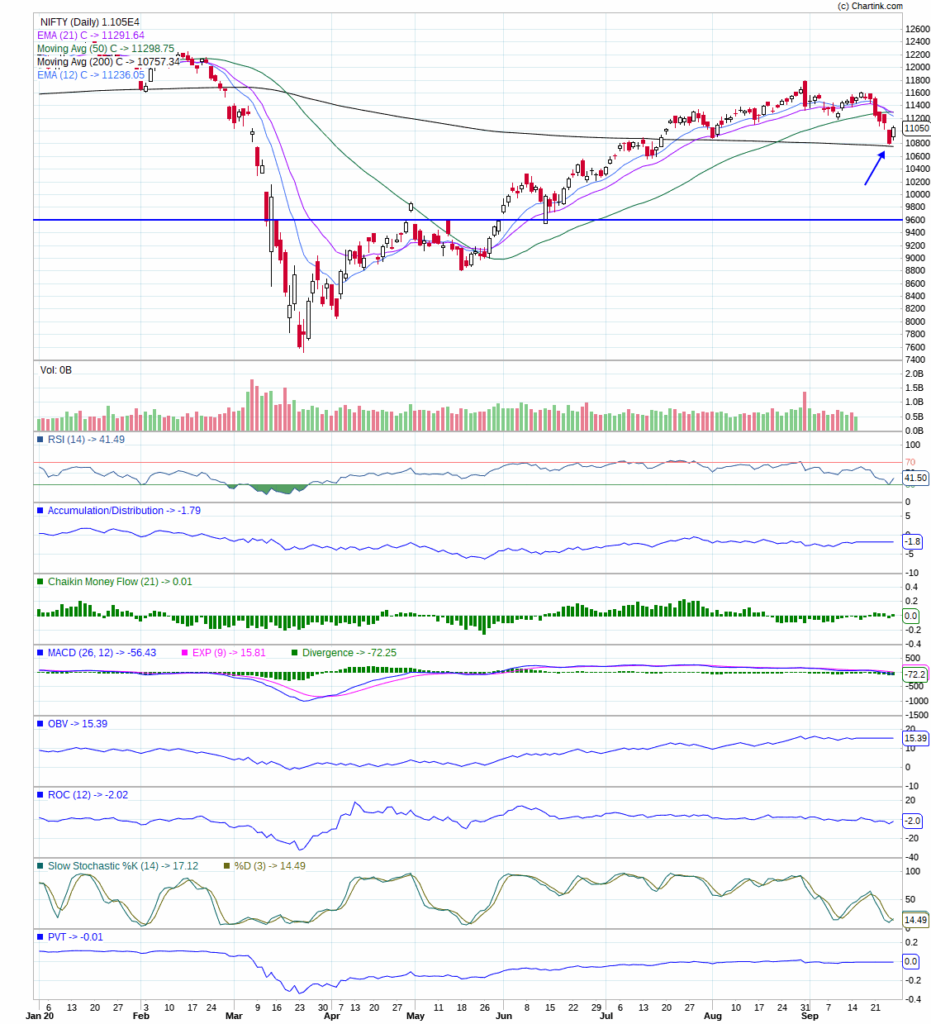

NIFTY corrected 1000 points before it recovered on Friday from its recent high of 11794 which is more than 8%, ideally that is supposed to be healthy correction on indices if not extend beyond 10%, beyond that it has been an alarming sign of impending deeper drawdown. It’s time to pay some attention to moving average lines because they help determine where potential support and resistance levels may lie. Two that have been mentioned quite often are the 50- and 200-day averages. Moves above and below the 50-day lines help determine the direction of short- to intermediate price moves. While the 200-day lines help determine the direction of major market moves. The fact that both two major stock indexes NIFTY and SENSEX took support precisely at their 200-day averages (black line, see chart below) raised the possibility of rebound to extend further after Friday’s gain. However, NIFTY broke down below the 50-day average (green line) support smoothly, therefore it may act as a resistance while going up. In order to resume its uptrend, NIFTY has to rise above its 50-day moving average, meanwhile we can expect a range bound scenario between support and resistance.

In the event that those underlying support level (200-day average) fail to hold, the next level of more substantial chart lies near its June lows in the vicinity of 9600 (blue horizontal line). In addition, there are multitude of factors that suggest the potential for more stock weakness ahead, vulnerability in the financial sectors is the one. However, technology stock is showing some strength, but negative divergences among few of the indicators is a cause of concern like I mentioned last week and we saw the repercussion with a sharp fall in their stock prices this week.

Hence, current configuration is not supporting a positive outlook.

Conclusion

Keep in mind that the stock market has entered into a phase where volatility is compounding on the back of uncertainties. That raises the risk for more market volatility which could last up to few months and beyond. Which warrant a more cautious attitude on stocks over the next couple of months. For a time being the moving averages on daily charts offer clues on where some potential support or resistance levels may lie. Hence, buyers need to be extra careful.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Respect the Volatility.!; Be a Savvy Investor..!!

Pankaj