Weekly Market Summary

It was quite the volatile week for the market. Although, NIFTY had a strong gap-up opening on Monday and surged to new high, however, rest of the week is being spent to digest that gain while having a wild swing of 250-points throughout the week in between Monday’s high and last Friday closing. Nevertheless, NIFTY managed to hold most of the gap-up gain occurred on Monday.

In the week gone by the benchmark SENSEX added another 812 points, or 1.60% to reach at 51544, similarly, NIFTY gained 239 points, or 1.60% to settle at 15163.

Current Outlook

After a strenuous rise last week, we witnessed some consolidation is taking place at higher level amid high volatility. It is difficult to expect the longevity of sideways move, but some useful and interesting facts are emerging. Though, it is quite easy to analyse the market or other indicators in their hindsight for the obvious outcome, however, it is arduous task to analyse the current market conditions to get the clue for the next course of direction of the market. Nevertheless, it is indispensable to analyse the historical data in conjunction with current market conditions in order to prepare ourselves for next possible move. Though, historic movements do not guarantee to repeat in same manner in the future still they provide quite useful information to take advantage of forthcoming move. As human nature, emotions, and responses to the market movements throughout history have largely remined intact. They are timeless. That’s why the same types of chart patterns that manifest themselves today (and will occur moving forward) and also existed year ago.

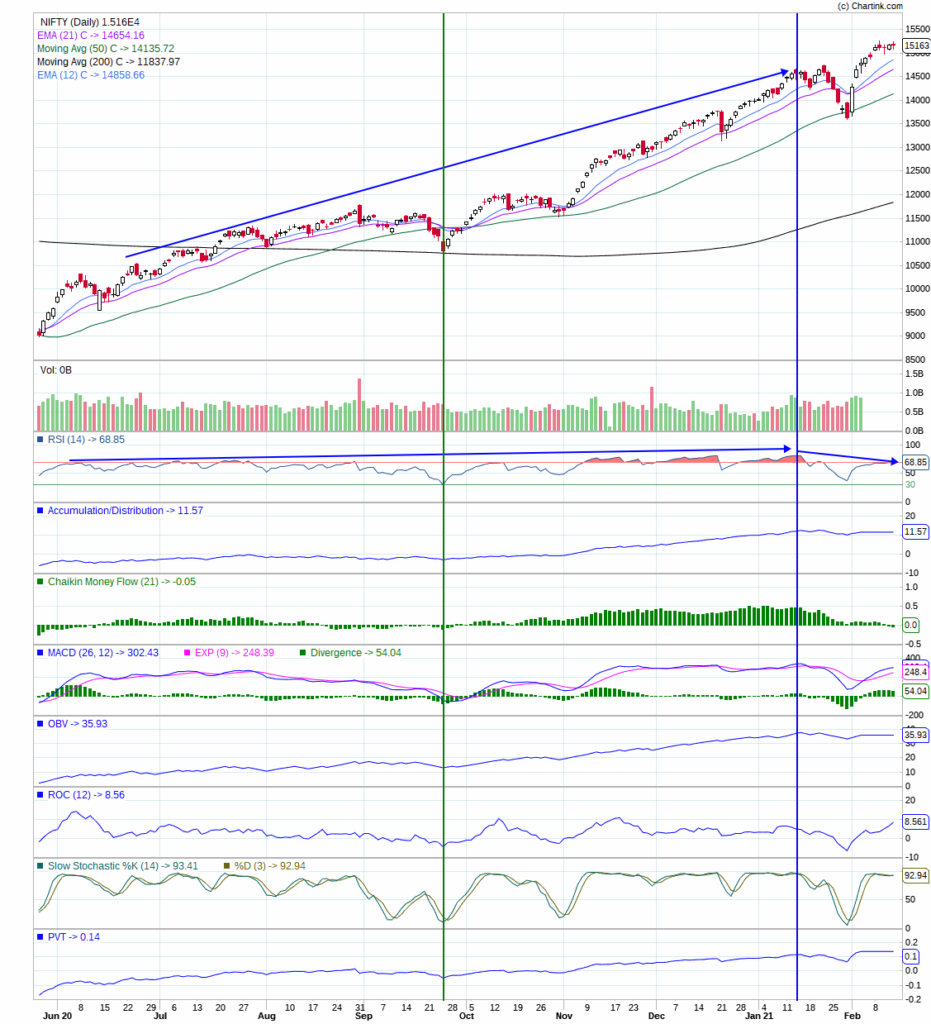

So, this article I am focusing on a 14-day RSI, as applied to current market conditions, but other oscillators/indicators such as MACD, could also be used (added in the lower panel of the chart). The principles are the same. I am using the RSI for this particular exercise because its calculation allows you to compare the performance of different or same securities using a common standard in different time frame. Moreover, since the RSI returns a series that cannot move above 100 or below zero, it’s possible to assign overbought/oversold zones to specific levels for all securities.

The markets are overly sensitive to oversold conditions when the primary trend is positive means it bounce off quickly from oversold level. By the same token, overbought conditions in a bull market are far more plentiful and do not have anywhere near the downside power that they do in a bear market. Another bull market characteristic is that oscillators can remain in an overbought state for an extended period without the usual adverse effect on the price. As we can see in the chart below panel RSI reading were persistently touching above 70 (overbought condition) quite frequently and was sensitive when reached to 30 (oversold level in September (green vertical line)) bounced-off quickly from there and again attained extreme overbought conditions above 70 since November till mid-January.

When the direction of the primary trend is about to mature, things get reversed and RSI refused to reach at overbought condition while price of the securities continues to move up that normally happens in the vicinity of cardinal top. That’s a sign of losing upside momentum. And once primary uptrend is over, gravity, pushes you down quickly. In a bear market, oversold conditions are generally followed by trading ranges or weak/non-existent rallies that needs to be confirmed yet as per given market conditions but some sort of losing momentum is evident.

Ipso facto, I can presume that outlook might be at the edge of the chaos.

Conclusion

There is a fair degree of probability that given condition can get reversed quickly and RSI may again reach to new highs, however, if it refuses to do so in line with the price, I would consider it a good sign of warning in advance and wait patiently.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be Patient…; Be a Savvy Investor..!!

Pankaj