Weekly Market Recap

As expected, sideways action on indices continued this week. On Monday, market plunged over 2%, perhaps on the back of rising Covid cases and rest of the week spent to recoup that loss. Nevertheless, amid roller-coaster ride industrial and metal stocks continued to rise and had a stupendous blow-off kind of rally along with descent rise in technology stocks.

In the week gone by the benchmark SENSEX lost 438 points, or .88% to close at 49591 and NIFTY closed almost flat with a loss of 32 points, or .22% at 14834. While BANKNIFTY led the decline and slid over 4%.

Current Outlook

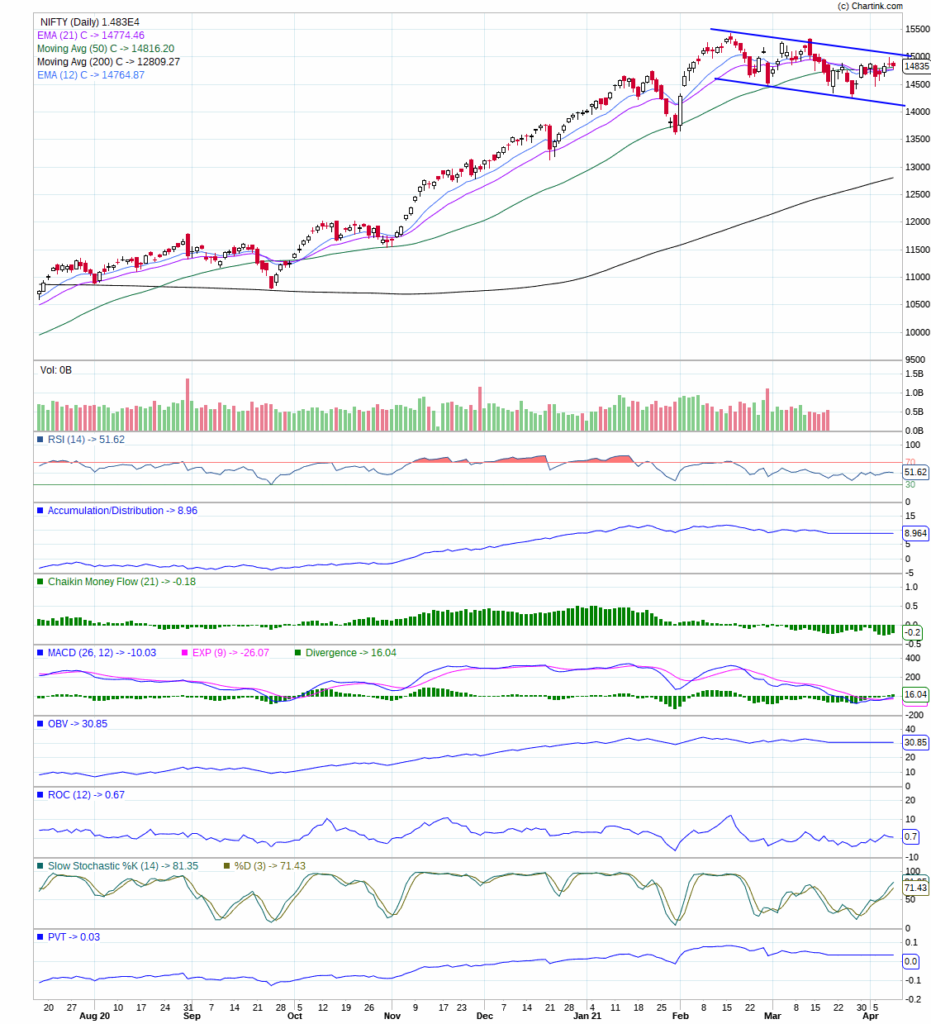

Last week, I mentioned that NIFTY is forming a downtrend channel whose angle of descend is not much tilted to the downside as a result NIFTY may continue to remain sideways for quite some time. Not much has changed in the technical configuration of NIFTY post this week as we can see in the chart below. However, deterioration in financial stocks is a cause of concern provided they have highest weightage in NIFTY.

Metals and cement have been bucking the downtrend since past few weeks and turned out to be the star performer this week to have had a blow-off kind of rally that suggest a topping action to me as this is a sign of buying exhaustion. In addition, technology continued to surge to new all-time high that supported the indices and precluded the downfall caused by the financials. Nonetheless, topping action is not visible in technology stocks but negative divergences among indicators with respect to price is quite pronounced than ever before that indicates they are about to form a cardinal top sooner than later.

Financials have been lagging since the rally started off last year post pandemic hit cascading fall, though 2-3 banking stocks have outperformed and attained new highs, but overall financials didn’t perform much in tandem with the other area of the market. And, at present, they seem to be the weakness in market. There is myriad of possibilities from here like turnaround in financials can further produce a gigantic rally in NIFTY or pull back in technology stocks along with financials may cause a ruckus in the market, or market may remain sideways for longer than expected. I think, in coming few sessions market should unravel the path. Moreover, VIX is hovering at the lower end of the range, indicates fast and big movement on either side is quite possible. The upcoming week is crucial for the financials as they stopped at the edge of chaos which may decide the next course of action in market in big way. Hence, outlook may continue to be sideways with an expectation of big move on either side sooner than later.

Conclusion

Market has a tendency to surprise, and it has done it vehemently in last one year, most importantly the major move comes unheralded, in fact it tends to remain sideways when expectations are high. As I wrote last week, trader should keep their positions light and wait patiently, let the market provide the clue for its impeding direction and keep a tight stop in your open positions.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be Patient…; Be a Savvy Investor..!!

Pankaj