Weekly Market Recap

In yet another down week, indices continued to drift lower amid so much negativity and fatality caused by COVID-19. Unequivocally, the environment is not propitious, nevertheless major indices managed to restrain the downfall to some extent. The horizontal support which I wrote about last week once breached but held so far.

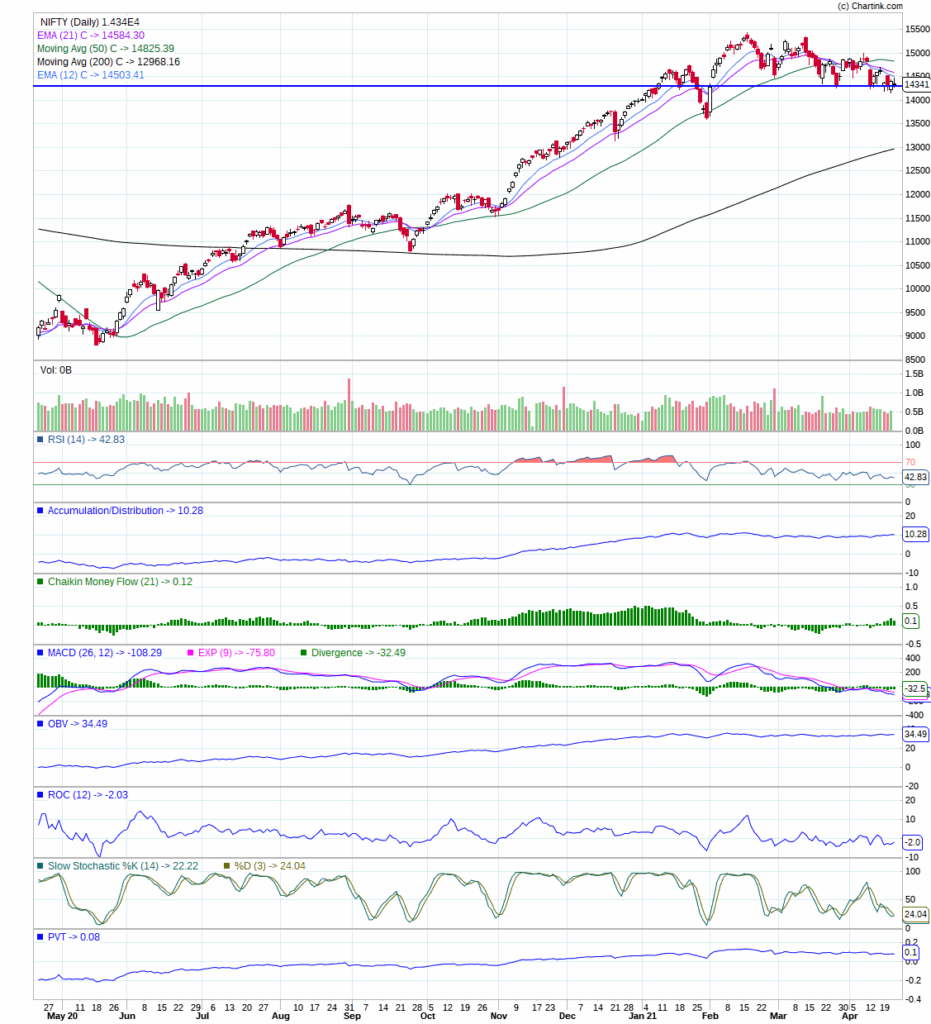

In the week gone by the benchmark SENSEX lost 953 points, or 1.95% to close at 47874, similarly, NIFTY fell 276 points, or 1.89% and settled at 14341. While BANKNIFTY unlike past week contained the losses under 1%.

Current Outlook

Although, the surrounding seems to be unprecedented pernicious and noxious amid soaring death rate caused by COVID-19, however, whose impact hasn’t been transmitted in juxtaposition to stock market. This is perhaps a prodigy of better days ahead, hopefully, situation will be under control sooner than later, but who knows? So far, the market is giving this message. Being a fund manager, I try to analyse and see the things as they are rather how they are being demonstrated by the media. Specially, the investment decision taken by the influence of media has always been devastating to your capital. It mostly let you in when prices have already gone up substantially, or make you exit when prices are close to the bottom. Certainly, news impact the stock prices and sometimes it acts as a catalyst to overextend the move on either side, but it has never been a great time to make an entry or exit decision. And, if you are following the technical sincerely you would have exited quite early.

Since, past few weeks I have been talking about the technical conditions which are not in favour of bulls and in my last note, I particularly wrote about the possible crucial horizontal support (blue line) on NIFTY as shown in the chart below. This support was marginally breached on Thursday but managed to hold on. Although, market is gradually drifting lower but so far selling has not been lopsided, in fact sharp recovery has been witnessed at lower levels. I think, predominantly, it is because of two reasons, firstly the retail participation is still not extremely high, and secondly the sentiments have turned more bearish than the prices that precludes the downfall. However, steep correction has already been occurred in financial stocks mainly because of high retail participation.

Furthermore, market plays a gimmick and perhaps it is a matter of time that NIFTY is still holding on at higher levels despite apparent weakness in financial stocks, courtesy to technology stocks. Technical divergences and VIX are a strong hint that something untoward is probably about to happen, but they are not infallible. Free fall is being witnessed in cement stocks this week which had a stupendous move in past one year, this type of move is predominantly dominant by institution investors and sometimes it is not easy for them to exit at higher levels in absence of retail investor that’s a reason free fall occurred when they start selling.

In nutshell, the surrounding is scary and disconcerting but both SENSEX and NIFTY held their support, however, weakness in financials makes an outlook alarming.

Conclusion

This is one of those times when most of the floating shares has been absorbed and held by big investors that’s make it ardour for them to exit as selling fraction of percentage stocks at times invite sharp selling. although, short selling is not an easy task in this market, but the probability of having a big gap down opening at any day cannot be ruled out. Hence, be cautious and be patient.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be Patient…; Be a Savvy Investor..!!

Pankaj