Weekly Market Recap

This week started off with gap down opening as expected based on the last week technical implication but soon managed to recoup all the losses and shrugged off negativity caused by COVID-19. Overall, it was the good week specially for most of the individual stocks as they continued to rise smoothly till Friday.

In the week gone by the benchmark SENSEX gained 424 points or .87% to close at 49206, while NIFTY closed up few notches extra on the back of stupendous rise in metal stocks with a gain of 192 points, or 1.31% at 14823. Whereas BANKNIFTY remained lackadaisical with a marginal gain of .37%.

Current Outlook

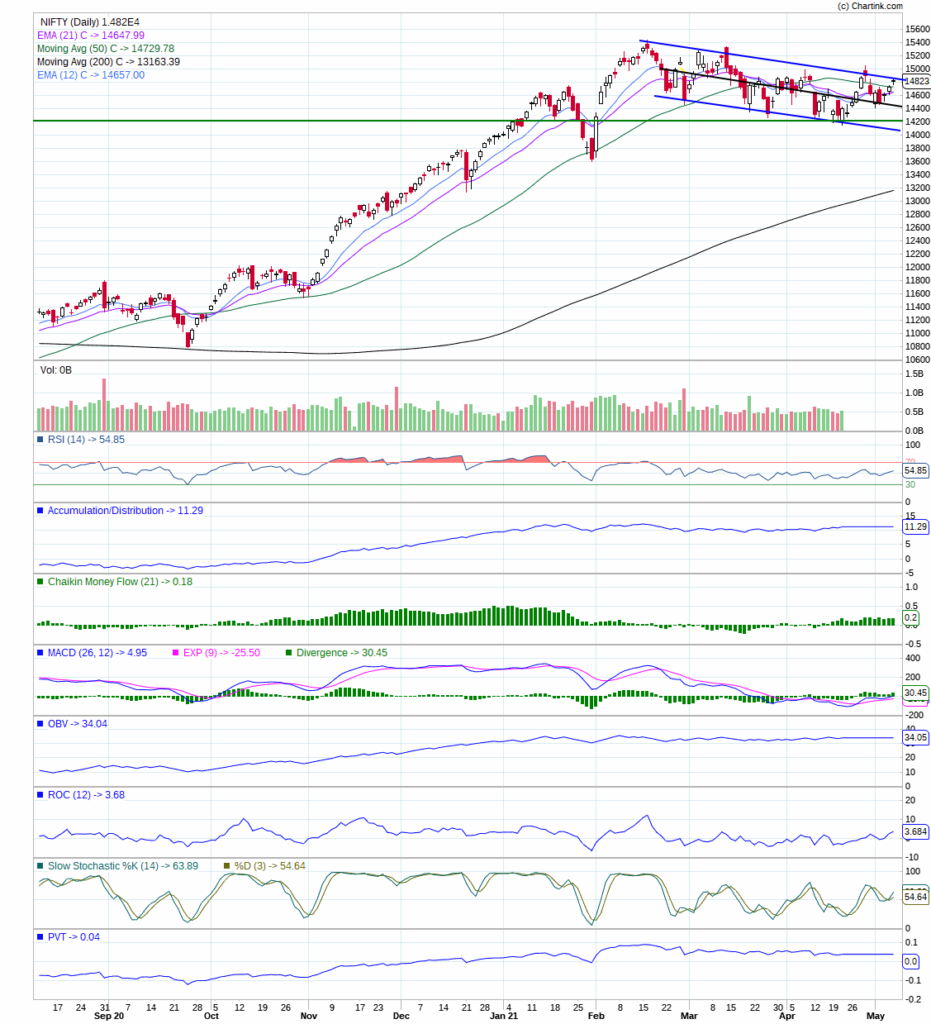

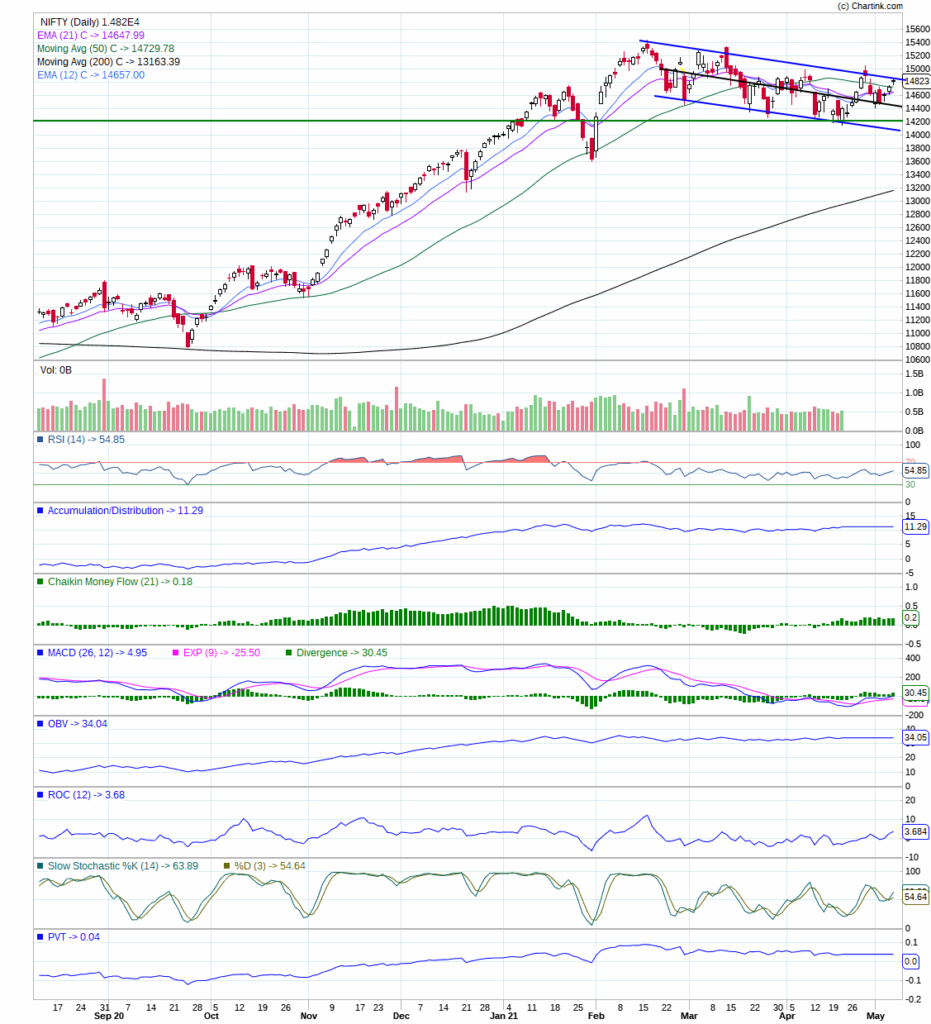

Last week, I talked about the false broke out and its negative implication. This week, I witnessed the change in behaviour, although this behaviour has been in play since NIFTY hold the horizonal support (green line), but this week I noticed rapid shift in dynamics from negative to positive. As I have mentioned few times in the past, we are facing the unprecedent volatile market where dynamics are changing quite rapidly so as we must be ready for that shift whether you are an active trader or a passive investor.

False breakout of last week hasn’t been resolved completely unless NIFTY close above previous high, however, it looks like there is fair probability that previous high will be taken out smoothly in coming week as NIFTY took a support in the middle (black line) of the falling channel (blue line) instead falling back to the lower end of the range. This could be a proceleusmatic configuration. If NIFTY manage to cross the above 15K mark, then I think new leg of rally towards the new high is quite possible. I fathom and notice that large group of stocks with in or outside the index are forming a bullish setup that could lead the indices to new high. Furthermore, VIX has come back at the lower end of the range but NIFTY is below from its previous peak that’s a bullish divergence.

However, some cause of concern is apparent in financial stocks provided they have maximum weightage in benchmark indices that could lead to some sort of disruption. Overall, setup is bullish, most importantly exit level is not far below. Hence, outlook seems to be ameliorating.

Conclusion

Unequivocally, the ongoing COVID crises will have negative impact on the economy, and for how long this crisis will continue? perhaps nobody knows. But yes, extra caution makes the sentiments weaker which has always acted as a contrarian indicator for the market that led the market higher. Sharp and deeper correction comes unheralded and now everyone is waiting for that. Trade technically and be patient.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be Patient…; Be a Savvy Investor..!!

Pankaj