Weekly Market Recap

Precisely in line with my analysis and expectation, NIFTY surpassed the previous peak and hit a fresh high this week, although both SENSEX and BANKNIFTY have yet to reclaim its previous peak. It infers that rally is not contained only to the limited stocks, in fact, participation from across the sectors is quite apparent. That is a good sign.

In the week gone by the SENSEX rose 882 points or 1.75% to close at 51422, similarly, NIFTY gained 260 points, or 1.72% to settle at 15435 and BANKNIFTY surged 534 points, or 1.54%.

Current Outlook

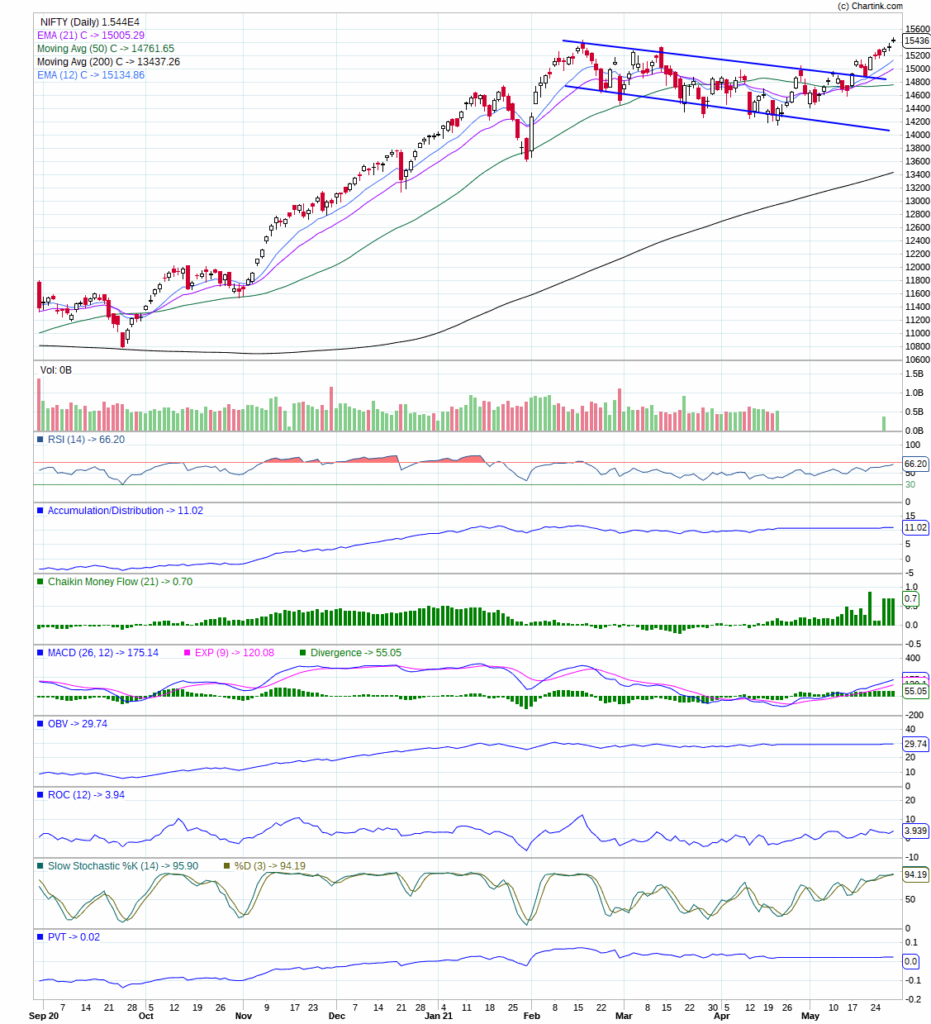

As I wrote last week, technically NIFTY is enunciating the strongest configuration since January which can drive the indices to new all time high and the same has turned out this week. Since, NIFTY has broken out above the falling channel, it is gradually inching higher and most importantly, the angle of escalation doesn’t appear to be quite steep which suggest there is enough upside potential left before it peak out as we can in the chart below. The longer it takes the farther it goes means NIFTY has consolidated for almost 5 months since previous peak, hence it has enough fuel to further drive the prices higher.

The VIX made a lower low last week and continued to decline, signalling no sign of peril at least in short term and there is enough room to decline further, history says cardinal top on indices formed when VIX falls to 10 or below, currently at 17.35. Furthermore, exponential rise among mid-cap and small caps supposed to be occurred at the time of final leg of rally, which seems to be at the initial stage, hence long way to go before they peak out.

Fundamentally, things might be getting frothy, however, so far,the ongoing result season has demonstrated a strong earing momentum among all the major sectors. Perhaps, it may continue for next 2 more quarters as pent-up demand seems to be huge.

I noticed a sharp sell-off among crypto currencies in past two weeks which have corrected more than 30%. I presume, this selling shall act as a source of fund for the equities which may further fuel the rally in equities globally. Hence, outlook seems to be effulgent at least in short term.

Conclusion

Greed and fear are the two emotional drivers of the market, and provided above mentioned conditions favour the bulls, I think, fear is still present in the large extent that again supporting the bulls. Hence, market is poised to go higher, but caution is always warranted so always keep a tight stop.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Keep Profiting…; Be a Savvy Investor..!!

Pankaj