Weekly Market Recap

The market continued to rally for the third straight week and remained buoyant before the earning season start in full fledge. However, major IT stocks have posted a mixed set of earnings, more or less in line with the expectation, so the stocks reacted accordingly.

In the week gone by the benchmark, SENSEX surged a whopping 2.47% or 1478 points to 61223. Similarly, NIFTY reclaimed its 18K mark by gaining 2.49% or 443 points to 18255. While BANKNIFTY gained 1.67%.

Current Outlook

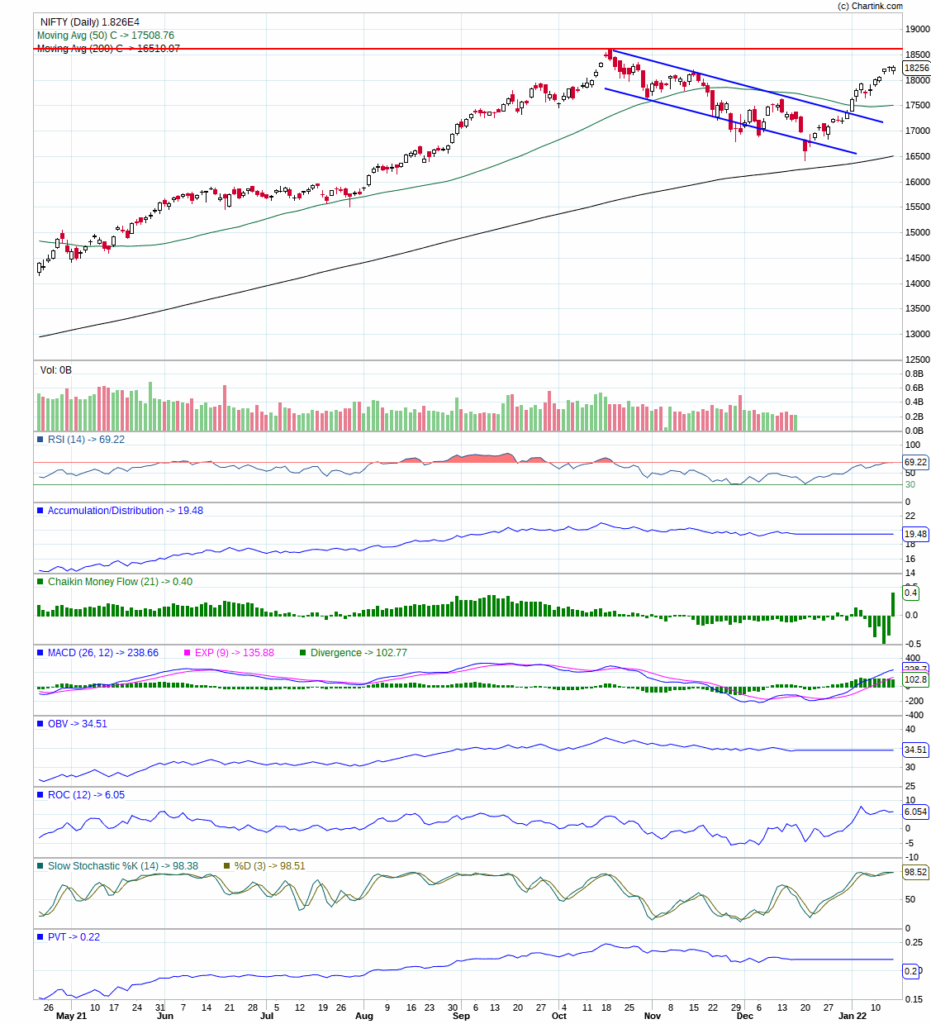

Since the breakout occurred on NIFTY last week the advance got more incisive and appears to rise further as VIX remained muted not suggesting any negative surprises on earning front. However, NIFTY has reached into the vicinity of the previous high as we can see in the chart below, the possibility of double-top formation is on the card as few of the NIFTY stocks are reversing from the double-top formation. The market breadth which appeared strong at the lower level or during the breakout above the falling channel (blue line) seems to have lost its strength at a higher level. Moreover, indicators in the lower panel also reaching to their higher reading suggesting a pause or a minor pullback.

As we move into the earning season, it is prudent to look at the NIFTY fundamentally. The current PE (price-earning) ratio of NIFTY is 25.37 after Friday’s closing. PE touched the highest reading 41.97 on February 8, 2021, since then it is falling persistently and reached its lower level 22.92 in the recent correction. Attributed to better earnings. Historically, the price has usually remained below the top of the normal value range 23; however, since about 1998, it has not been uncommon for the price to exceed normal overvalue levels, sometimes by a lot. As per my founding, the market has been mostly overvalued since 2003, and it has not been undervalued (below 14) since then. We could say that this is the “new normal”. However, the “new normal” is the only reason we have always witnessed a sharp and deeper pullback since 2008. Note that the market takes time in establishing a cardinal top, but quite less in making a bottom, which means exit discipline should always be ready especially at a time when indices are making new highs.

Technically, the picture is strong; however, the pullback of some magnitude is expected in the vicinity of the previous high or after forming a double top. Hence, the outlook is cautiously optimistic.

Conclusion

Fundamentally, the market continues to be grossly overvalued, and this will continue unless; earnings improve substantially, or price declines into the normal zone, or a combination of the two.

Feedback, comments, suggestion, or questions are welcome in the below comment section or at pankaj@savvycapital.co.in.

Be Patient; Be a Savvy Investor..!!

Pankaj