Weekly Market Recap

In yet another corrective week market continued to drift lower, but the closing is not as bad as it could be. This week price action is quite similar to last week action where NIFTY plunged on Monday and rest of the week is being spent to recoup the losses, though this week plunge was bigger than last week, but the pattern is almost similar.

In the week gone by the benchmark SENSEX shed 759 points, or 1.53% to settle at 48832. Similarly, NIFTY lost 217 points, or 1.46% to close at 14617. While BANKNIFTY witnessed the major decline but manage to recoup more than half of its losses to close in line with benchmark indices with a loss of 1.45%.

Current Outlook

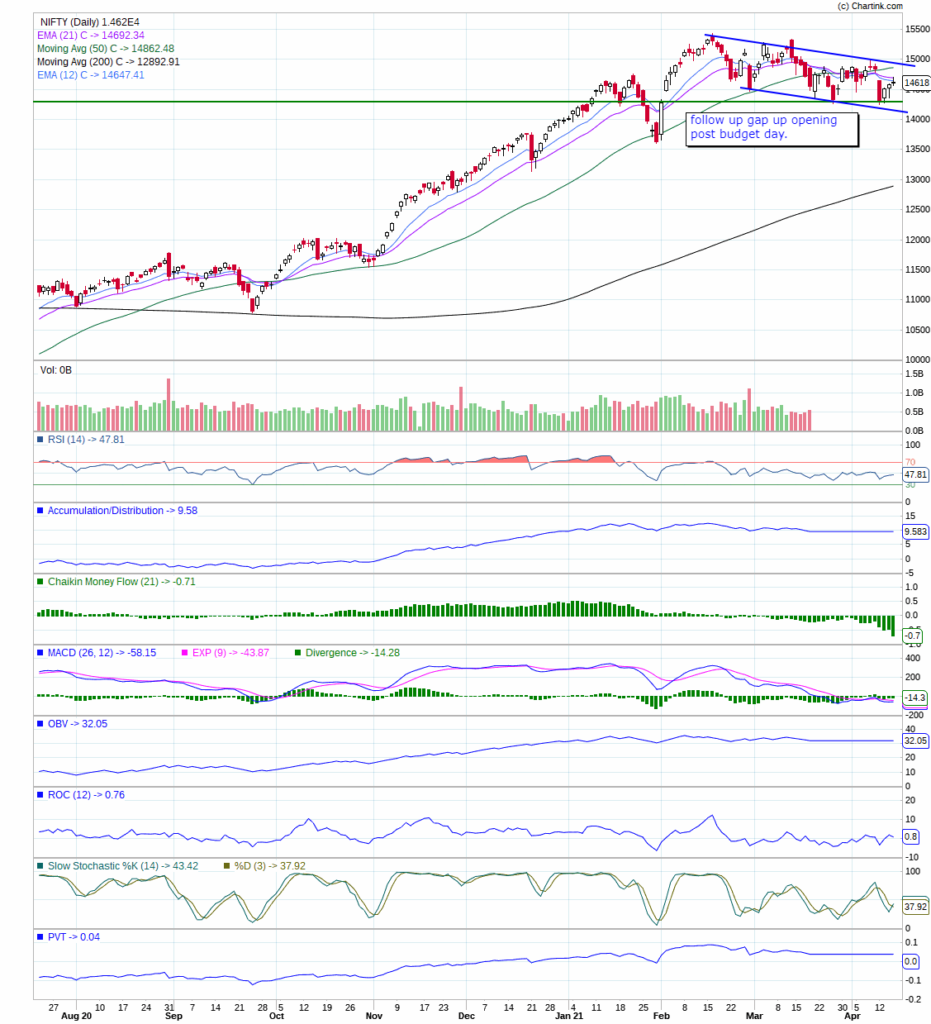

Since past three weeks, I have been talking about the formation of falling channel on NIFTY means price is making a lower highs and lower lows that presumably be not the good news for the bulls until proven otherwise. Although NIFTY had the biggest one day fall on Monday in last two months but appears to have found the horizontal support in the vicinity of last low which is coinciding with the gap up support formed post union budget see the green line below on the chart.

Now provided the looming pessimism due to spike in COVID-19 cases, the real question is whether the NIFTY will hold or break that support.? Well, technically NIFTY seems to have found the support, but it is very much in the falling channel (two blue declining line) which is not a bullish configuration. However, as long as that horizontal support is maintained we can expect the range bound scenario may continue between the last month high and recent low. Once that support is taken out it could be quite devastating as it may lead to profit booking among big or institutional investors and that would be enough to cause a ruckus in the market.

In my last note, I mentioned two possibilities either financials turn-around from here and support the indices, or technology may also follow the downtrend like financials whose impact would be quite significant on indices. This week technology once appeared to follow the downtrend but rebound sharply next day. However, I think these two possibilities and sectors are carrying the highest weightage in defining the next course of direction in the market. Moreover, the technical indicators in below panel of the chart resting at the middle of the range suggesting enough room to either side of the market, but falling channel goes in the favour of bears.

Hence, technically, it is prudent to watch for horizontal support (green line) in order to get the better view of the impending action. So far outlook seems to be cautiously sideways.

Conclusion

There are group of strong stocks which continued to buck the downtrend and kept their uptrend intact but most of them have overstretched their run that needs to be resolved with some sort of pull back or sideways action. If NIFTY break below its horizontal support then these stocks may provide decent entry in next leg of rally, but at present patience is the key. You can ruminate to book the profit; perhaps fresh buying is not a great idea at present.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be Patient…; Be a Savvy Investor..!!

Pankaj