Weekly Market Recap

Finally, much awaited correction arrived this week but in a dramatic fashion when major indices posted a biggest one day fall since the fastest ever recovery started-off from March low. However, the correction occurred and sustained only one day which is followed by sharp recovery as it has been the style of recovery in the epic year 2020.

In the look-like the most happening week, the benchmark SENSEX had a wild swing of over 2000 points but closed almost flat with the subtle gain of 12 points, or .03% at 46973. Similarly, NIFTY closed with a loss of 11 points, or .08% at 13749. While BANKNIFTY again started to underperform and lost 1%.

Current Outlook

Although the recovery after the dramatic fall was fabulous, but I think, the market has shown us a sign of peril and suggesting that indices have entered the danger zone. That means we are awfully close to cardinal top. In these holiday shortened weeks volatility could be the central story of the stock market indexes. Empty trading desks and light volume make it easier for markets to get pushed around.

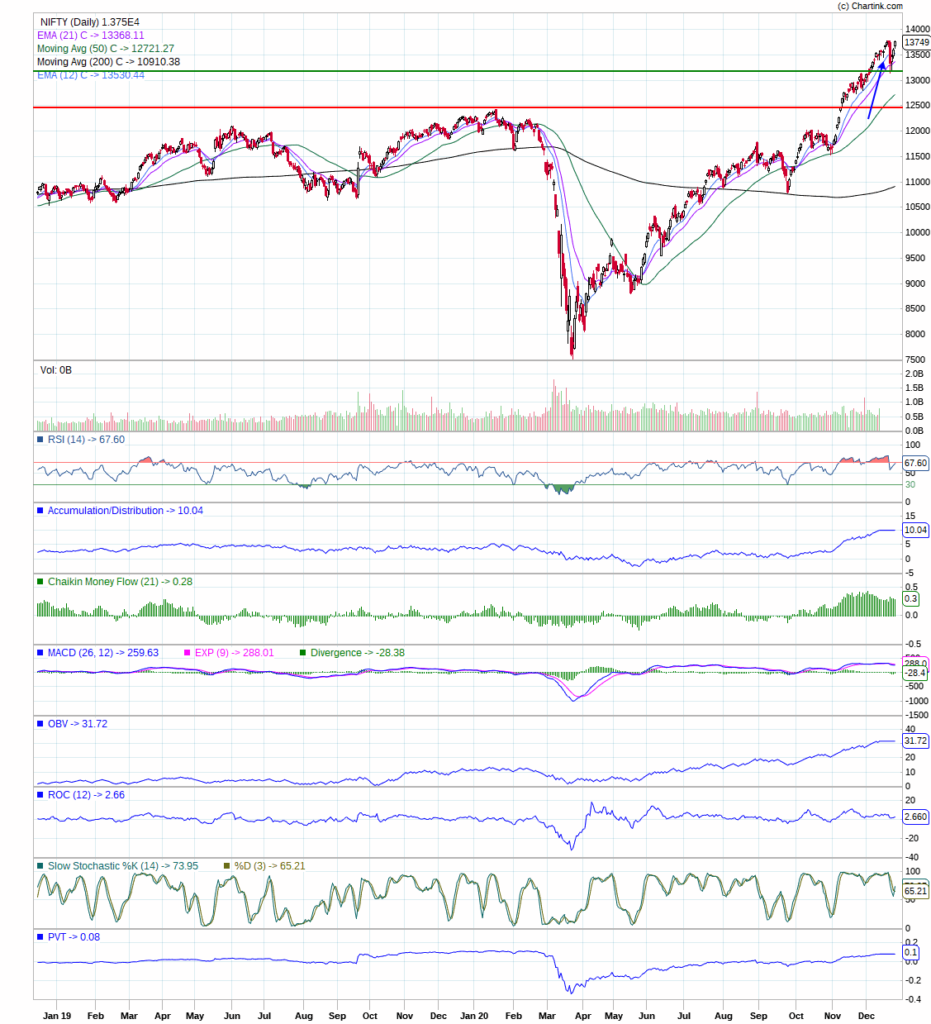

Last week, I talked about the possibility of long-term breakout in more than few stocks which has demonstrated a horizontal or rectangular shape of consolidation which is prerequisite for potential upside, however, the NIFTY has already seen a linear expansion in last decade, moreover the unprecedented rally from its March low seems difficult to sustained in the absence of side-ways or consolidation move. I still give the prevailing uptrend all due respect and can expect higher prices ahead. But the current area above the red horizontal resistance line (see the chart below) is the Danger Zone provided the angle of escalation is quite steep. Note the divergences among indicators in below panel could be the case this time. A price break below the last week low shown by green line could bring down the NIFTY up to red Resistance line. Rapid reactions witnessed this week are often tend to pullback the NIFTY at least to some extent in next few says. Thus, the reason for considering this the Danger Zone.

Hence, the outlook is cautiously optimistic for group of individual stocks, but less optimistic for major indices.

Conclusion

I haven’t seen any incident in past structures which have resolved by price accelerating upward without substantial consolidation. Could it happen this time, only time will tell? And the strong consideration could be that pull back up to red line will become a support zone that may set up a new uptrend. We will likely know soon.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Happy Investing and a Prosperous 2021 to you and yours…!!

Pankaj