Happy Independence Day…!!

Weekly Market Recap

It was quite a standoffish week for the market till Thursday with an alternate days of minor gain and loss, but having dispositioned slightly upward, since substantial move came in on Friday that made the weekly closing for the indices in red.

In the week went by the benchmark SENSEX closed with a loss of 163 points, or .43% at 37877, similarly, NIFTY lost 35 points, or .32% and settled at 11178.

Current Outlook

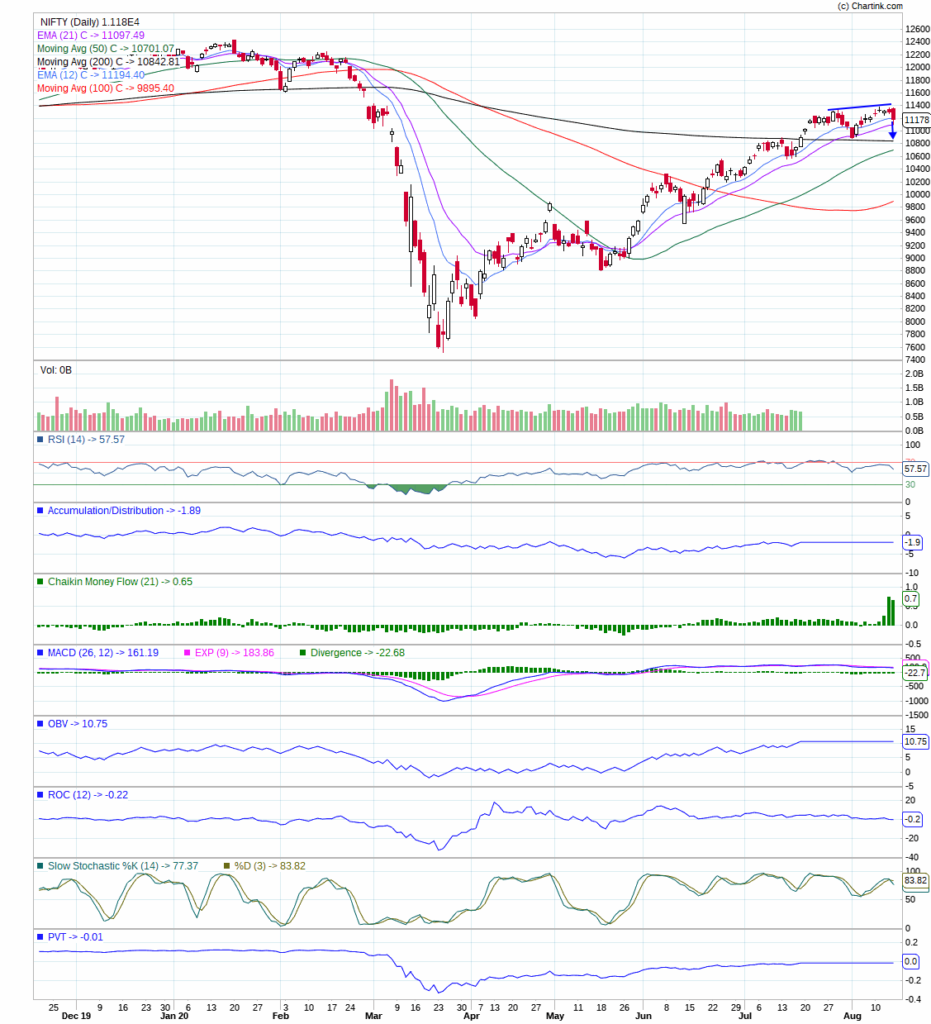

The dominant feature appeared on the chart post Friday correction on NIFTY is double top formation as can be seen in the chart below. Again, it was the financials who led the fall and weigh down the over market. I have been quite vocal about the weakness in financial stocks for the past few weeks and specifically mentioned last week that it is not the great space to be in unless we get the veritable evidence of their strength. I think, they will continue to lead the fall for some more time at least. However, autos particularly have done quite well until recently, now appeared to have ebb off on Friday at critical inflection point and turned out to be the biggest looser after financials. Both these sectors have high degree of correlation since early 2014 to 2018 as both these sectors have done exceptionally well as compared to rest of the sectors. Nonetheless, as expected, metal and IT stocks buck the downfall and posted a solid gain, though some profit booking is expected going forward if correction continue in NIFTY.

The double top on NIFTY is quite apparent while second top is tilted upward, the first implicated downside target after this formation is the lowest point between the tops at around 10880 which may act as a strong support. However, the validity of the double-top formation only gets intact after breaking the support which is the lowest point between the peaks and in this case that level is also coinciding with the 200 SMA (black line) as depicted in the chart below. Hence, the price range of 10800-900 on NIFTY is crucial going forward. If that level breaks it could be quite pernicious. In addition, the negative divergence on some of its important indicators suggest that correction is more likely.

The market is changing its course of direction quite frequently and not only that the swings are quite extreme on either side. Therefore, it is axiomatic that the investor or trader should seek a proper entry level or digress themselves from buying as upside momentum is gradually diminishing that makes the outlook negative.

Conclusion

Financials are making the Indian market quite vulnerable as they are still enjoying the maximum weightage in indices. Perhaps, the time will come few of the banking stocks will be out of the index sooner than later. NIFTY traders fortune is mostly relying on banking stocks; hence it is better to look out for better opportunities in relatively better sector but always ready with selling discipline.

Feedback, comments, suggestion or questions are welcome at below comment section or at pankaj@savvycapital.co.in.

Be patient…! Be a Savvy Investor..!!

Pankaj