Weekly Market Recap

Amidst government stimuli measures announced last week, and further RBI measures to ease -off liquidity this week by reducing Repo and Reverse Repo rate, market continued to drift lower. The moves are expected to revive an ailing economy hit by the covid-19 pandemic, but so far market seems to be unwitting and not impressed from those measures, consequently major indices witnessed a third consecutive weekly fall.

In the week gone by the benchmark SENSEX closed down by 425 points, or 1.37% at 30672, similarly, NIFTY lost 97 points, or 1% to close at 9039. While BANKNIFTY again had a cascading fall of over 8%.

Current Outlook

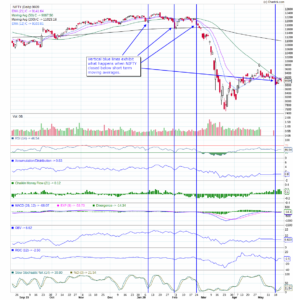

In my last weekly blog, I exhibited and noticed the price behaviour on NIFTY when price closed down by pivot short term moving averages (click here to see it https://savvycapital.co.in/market-strategy/govt-stimuli-measures-fail-to-impress-the-market/). Provided the last week technical configuration when NIFTY fourth time in last nine months closed precisely below the short-term moving averages and based on the past behaviour and probability, I expected the NIFTY to fall this week and market did the same in line with my expectation. The same configuration is still intact on the chart below. So, it is prudent to stick to that analysis among myriad of possibilities unless proven otherwise.

Although, it is untoward, but it is difficult to expect the conditions to be ameliorated in near future, especially at a time when financial stocks are conspicuously falling and underperforming the broader market significantly. Provided congregation of financial stocks still have the maximum weightage among major indices, the indices may continue to dwindle down in the foreseeable future.

Though, there are few areas of the market which are showing some strength like technology that may support the indices, but they have to perform rhapsodically well in order to nullify the lopsided effect of financial stocks. Hence, outlook remains negative except for few stocks.

Conclusion

It is indispensable to note that we are now in the throes of a different kind of a market event, not brought by market forces on the liquidity stream as central banker across the globe are pumping up the enormous amount of liquidity into the system, which may not necessarily be the right solution, but it is the one they are going with. And the result on the market with respect to efforts is ostensibly not propitious. Hence, be alert.

Feedback, comments, suggestion or questions are welcome at below comment section or at [email protected].

Keep masking …!, Be a Savvy Investor..!!

Pankaj