Weekly Market Recap

It was quite a week for the market. Though the week started off on a positive note on Monday and suddenly turned around sharply the next day and continued to fall throughout the week; consequently, the major indices have given up their last two-week gains. Almost all the sectors ended in red while technology seems to have lost its resilience and led to the decline.

In the week gone by the benchmark, SENSEX lost its 60K mark and plunged 2185 points or 3.57% to 59037, similarly, NIFTY dived 638 points, or 3.5% to close at 17617. While the decline in BANKNIFTY was restrained to 2%.

Current Outlook

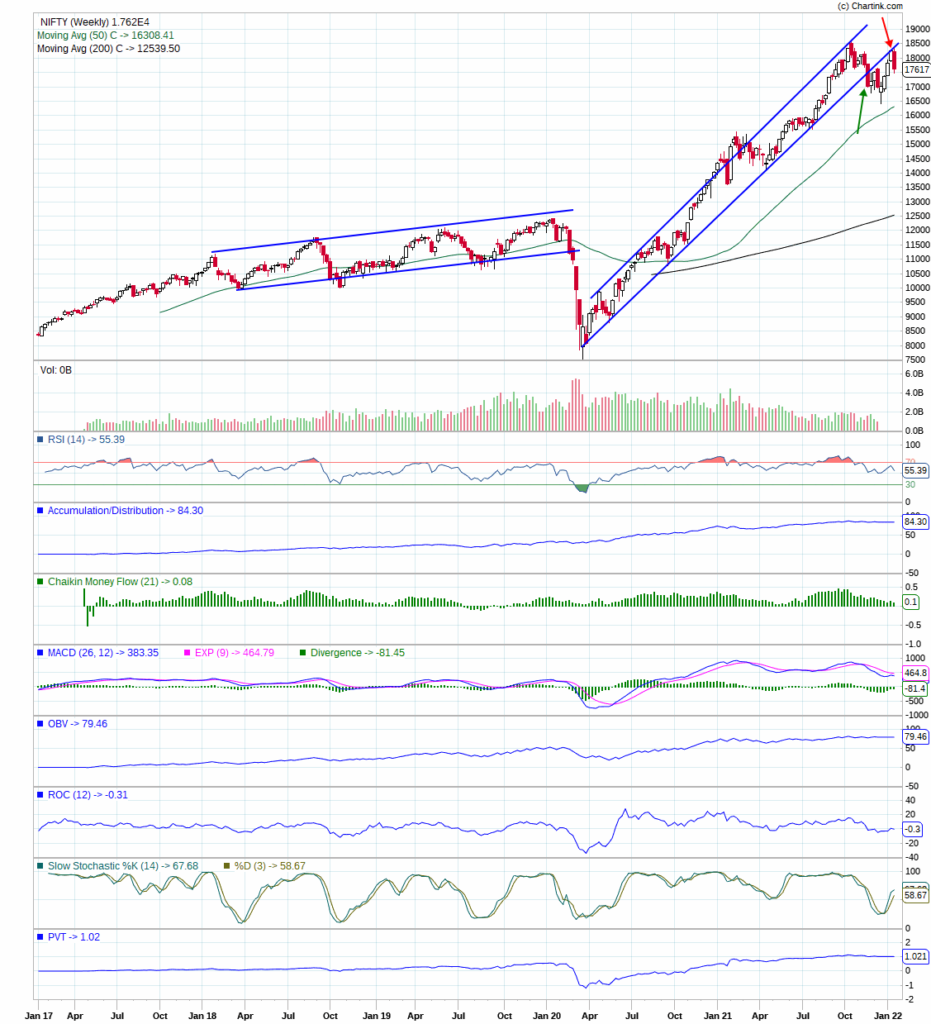

The dominant feature on the below chart of NIFTY is the double-top formation while the second top is tilted downward. Last week, I wrote about the same and did expect some sort of pullback in the vicinity of the previous top. Looks like, we have got the confirmation this week. It is indispensable to analyze the chart in all the time frames and the below weekly chart is enunciating a better picture to understand the possible and impending outcome. As we can see, since the covid crash in March 2020 the angle of escalation on NIFTY is quite steep, so far, the price has been advancing in a narrow rising channel where the upper line acted as a resistance, or a supply area and lower line acted a support or demand zone. In a previous recent pullback, the price was broken below the support line as annotated by the green arrow and bounced precisely up to the broken support line as annotated by the red arrow but couldn’t get above that line. This is a classic example of trend breaking and support turned into resistance on a long-term weekly chart. It could be quite pernicious in nature and has a bearish implication for the stock prices.

Moreover, the indicators in the lower panel are rolling down and have enough room to fall before oversold conditions are formed, which means the price can dive deep without giving a relief rally.

In my last few blogs, I wrote about inflation and perhaps its effects have rippled out towards the stock prices and all other financial instruments except in gold. As there was a significant decline of over 15% in cryptocurrencies as well this week. Whether it’s inflation or for whatever reason, I don’t know, but I believe the trend analysis seems to get an early indication of liquidity waves that are going to subsequently hit the stock market. The magnitude of movements is different and hard to prognosticate the fall after falling below the trend line, but I do care more about exiting and dancing with the steps than ignoring and hoping for the reversal.

There is a lot to share, but in nutshell, the above conditions have alerted me and given me a sign of peril. Hence, the outlook again turns out to be in favor of bears or gloomy.

Conclusion

The immediate implication of breaking the trend is that a corresponding decline in stock prices should still have more to go, early 2020 decline is the perfect evidence. I don’t know the decline will continue or not, but my rule-based model has asked me to exit.

Feedback, comments, suggestion, or questions are welcome in the below comment section or at pankaj@savvycapital.co.in.

Be Disciplined; Be a Savvy Investor..!!

Pankaj